Check Income Tax Number South Africa

The institution has undergone a revamp in recent years in order to improve its systems and processes.

Check income tax number south africa. 18 february 2016. The south african tax identification number is only issued by the south african revenue service and can be found on all taxpayer specific correspondence addressed to the taxpayer. Don t click on any links please send it to email protected see our latest list of scams here. You are required to have a valid south african id.

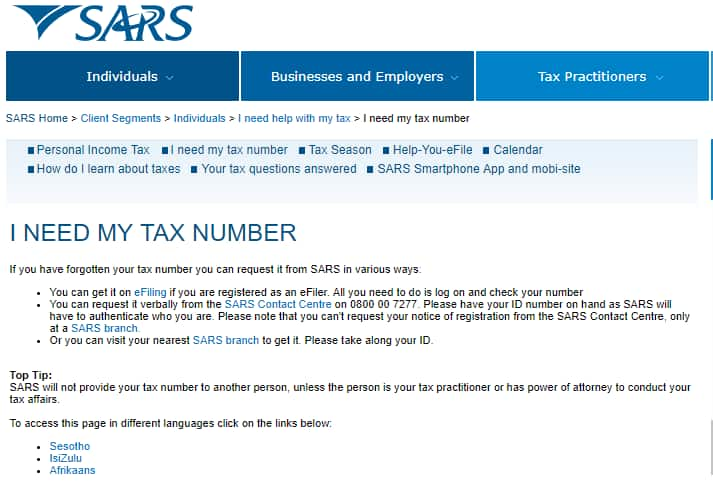

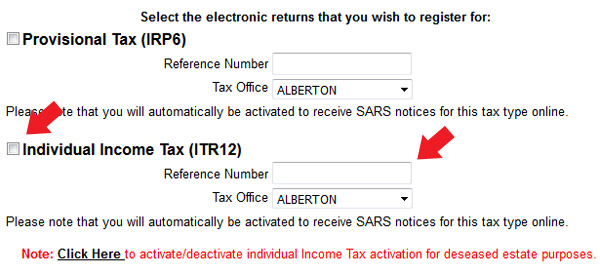

See the tax tables the 2019 year of assessment commonly referred to as a tax year runs from 1 march 2018 to 28 february 2019. For more information see the step by step guide to register for efiling and register for personal income tax automatically. I forgot my tax number how do i get it agently. If you are registered for income tax you will be required to submit an annual income tax return to sars.

Before doing so one has to apply for a tax reference number and here is all you ought to know how to get your tax number. If you have checked everywhere and still cannot find your tax number. Please have your id number on hand as sars will have to authenticate who you are. What can i claim.

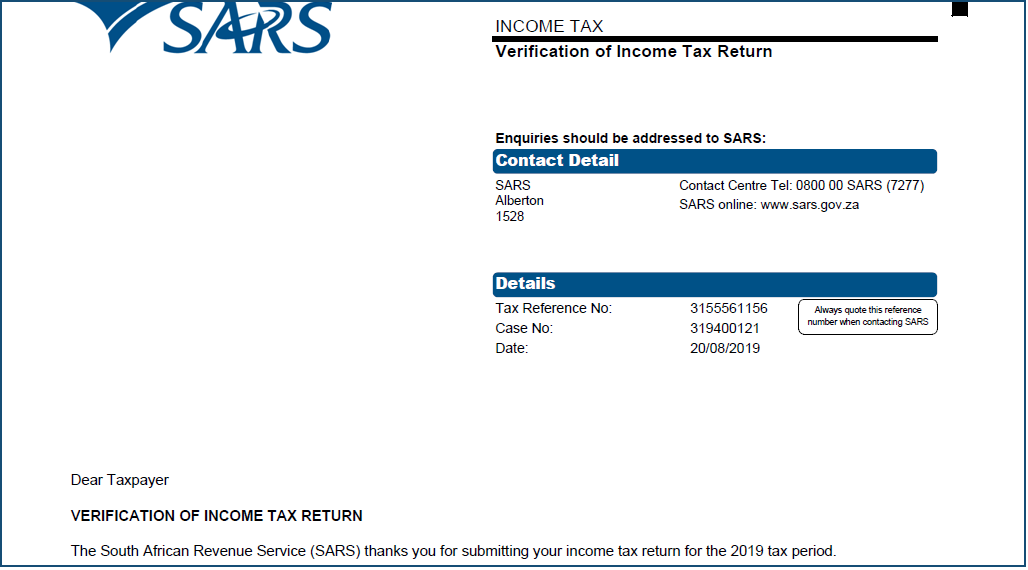

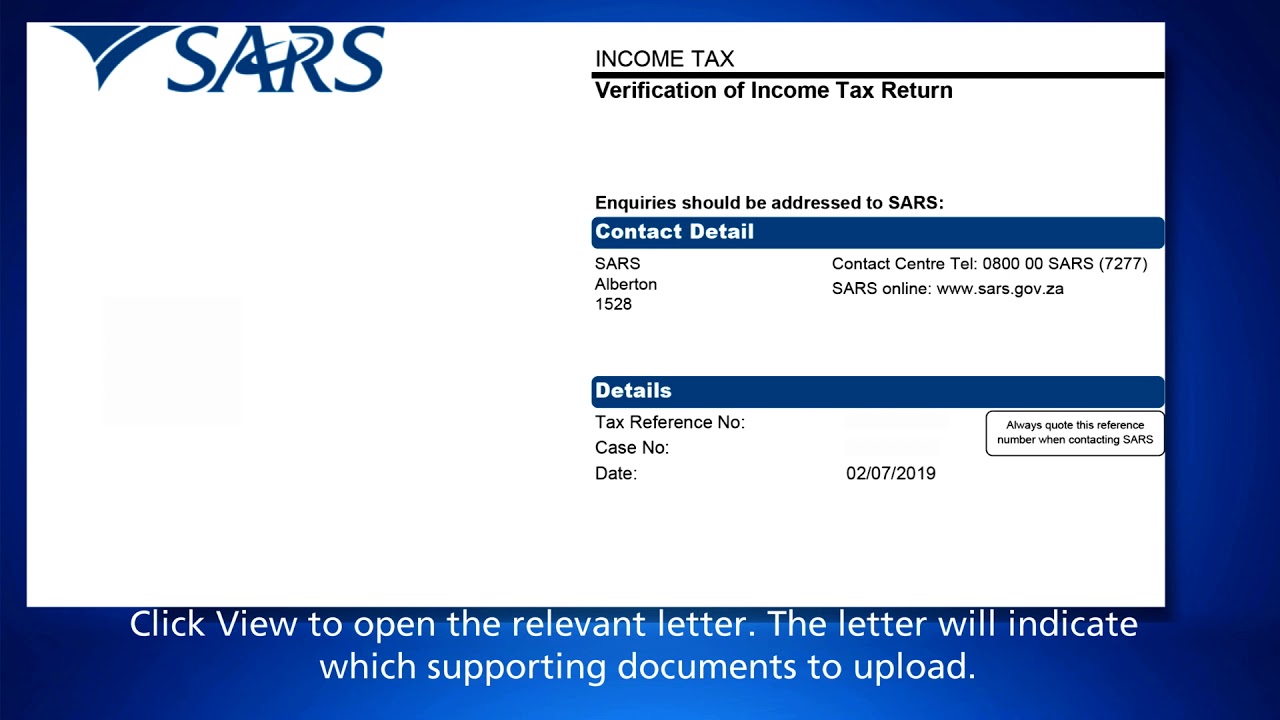

Other places to check for your tax number. All you need to do is log on and check your number you can request it verbally from the sars contact centre on 0800 00 7277. Other places where you would find your tax number is on previous tax returns or letters from sars your tax number may also be on certain certificates or tax certificates such as medical retirement annuity or pension certificates. Visit the covid 19 online resource and news portal at www sacoronavirus co za.

The south african revenue services sars is the tax authority in south africa and has a mandate to collect tax money from the country s citizens who are earning above the regulatory tax threshold. All individuals must register as taxpayers with the south african revenue service sars within 60 days of receiving their first income. Income tax in south africa was first introduced in 1914 with the introduction of the income tax act no 28 an act that had its origins in the new south wales act of 1895. Posted 19 february 2016 under tax q a petros says.

Simply register on efiling and if you do not yet have a personal income tax number sars will automatically register you and issue a tax reference number. The act has gone through numerous amendments with the act presently in force is the income tax act no 58 of 1962 which contains provisions for four different types of income tax.